Fraud is one of those things you may not pay too close attention to, until it happens to you. And unfortunately 3 million people were impacted by this crime in 2018, (1) reportedly losing about $1.48 billion (an increase of $406 million from 2017). (1)

What in the world is going on? The concept is simple – the rise of our digital marketplace (the use of smartphones, laptops and other digital devices) is driving online interactions between businesses and consumers, leaving our information vulnerable for potential stealing. If you think it can’t happen to you, think again.

Consider how much or the type of things you use your digital devices for. One study notes the top activities performed on devices include: online shopping, personal banking, playing video games, applying for driver’s licenses, getting quotes/insurance policies, applying for credit cards/loans and filing taxes. (2) Do any of these sound familiar? Most of these activities impact everyone in some way, meaning your information is alive out there in the digital world.

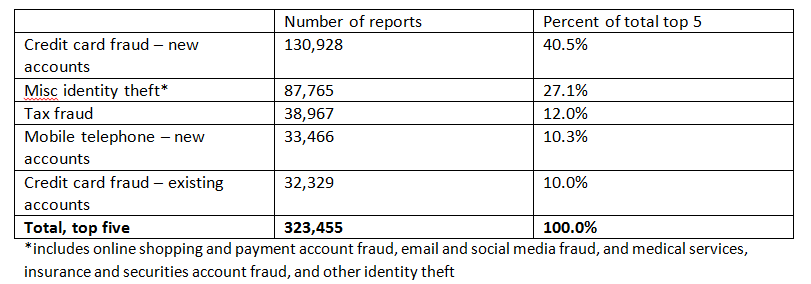

Although fraud can come in many shapes and sizes – from identity theft to making unauthorized purchases, here are the top 5 types of fraud reported in 2018: (1)

Considering over half of the top 5 fraud reports are related to credit cards and the average American has 2.6 credit cards (although when you exclude the 29% of Americans who don’t have any credit cards at all, the average credit cards jumps up to 3.7 per American). (3) This is an important facet of life you should put up guardrails to protect against.

Here are some simple ways to do so:

- Be Smart: in other words, use your common sense. It’s really easy to steal a credit card number when it’s in plain sight, so do your due diligence to keep your credit cards in a safe, secure spot and put it away promptly after using it.

- Shred it: get in the habit of shredding anything that could get in the wrong hands. This could include your bank statements, new credit card offers or old/expired credit cards. Dumpster divers are still making their rounds and can still find that statement buried in the trash.

- Go Paperless: this isn’t just better for the environment and cuts down on your trips out to the mailbox, but it is also more secure and can minimize the chance of your statement getting in the wrong hands.

- Review Billing Statements: even if you do go paperless on your billing statements, get in the routine of reviewing your billing statements consistently. This is typically where you will see the first sign of fraud or unauthorized charges. If you don’t recognize something (anything!) on your statement, contact the issuer immediately to discuss.

- Set up Automatic Alerts: make technology your friend and set up alerts to automatically get notified either via text or email for transactions such as purchases over a certain amount, credit card usage in a different location or international purchases. This just adds another set of “digital” eyes to your account to keep it all in check.

- Pay Attention to Receipts: yes, some businesses still make you sign on those paper receipts. But this is still a step in the payment process and you should confirm the amount is correct before signing. If there is a blank line for a tip, be sure to enter in the amount, write 0 or put a line through it.

- Keep Your Digits Private: your credit card isn’t a phone number, so it should never be given out. Although you may trust your kid or co-worker to make that one-time purchase you discussed with your card, the ripple effect of your number getting out of your control can result in fraud. The answer here is to be the sole owner of your credit card number, no matter the situation.

- Use Your Head Online: if it looks or smells “phishy,” it probably is. Phishing and scammers online can look legitimate, so be cautious before clicking on any link you don’t recognize. Whether it appears to come from the bank or credit union, or if it asks for your credit card information, don’t take it lightly. This also relates to phone call scammers – if your grandma is all of a sudden in the Bahamas and asking you to wire money, think again. You can always call the institution to confirm if something is real before taking any action.

- Secure Websites Only: before entering any personal information into a website, ensure it’s secure. Luckily it’s very easy to check the address bar for https:// to confirm it’s a legitimate site.

- Don’t Skimp on Passwords: gone are the days you can get by with passwords as your last name, birthday, a kid’s name, pet’s name, or any combination of the above. Best practices for creating a strong password include length, mix of letters (upper and lower case), numbers, and symbols – plus no ties to your personal information, and no dictionary words. Although you may think your standard password may work across all your log-ins, the chances of someone figuring it out and as a result, accessing your entire digital life aren’t worth the risk.

ISU Credit Union offers peace of mind with our identity theft protection service called Fraud Defender. Enjoy this benefit as part of our Rewards Plus Checking account!

Just like you put on a seat belt when you get in the car or wear a helmet when you ride a bike, you should also make a habit of implementing the right activities to protect you and your family against fraud. Just like most people don’t plan to get in an accident or fall off the bike, if it happens to you – you’ll want to know you did everything you could to avoid it and minimize the impact.

(1) https://www.iii.org/fact-statistic/facts-statistics-identity-theft-and-cybercrime

(2) https://www.experian.com/assets/decision-analytics/reports/global-fraud-report-2018.pdf

(3) https://www.fool.com/the-ascent/credit-cards/articles/how-many-credit-cards-does-the-average-person-have/