-

SavvyMoney® Credit Score

SavvyMoney® Credit ScoreGet Savvy with Your Money!

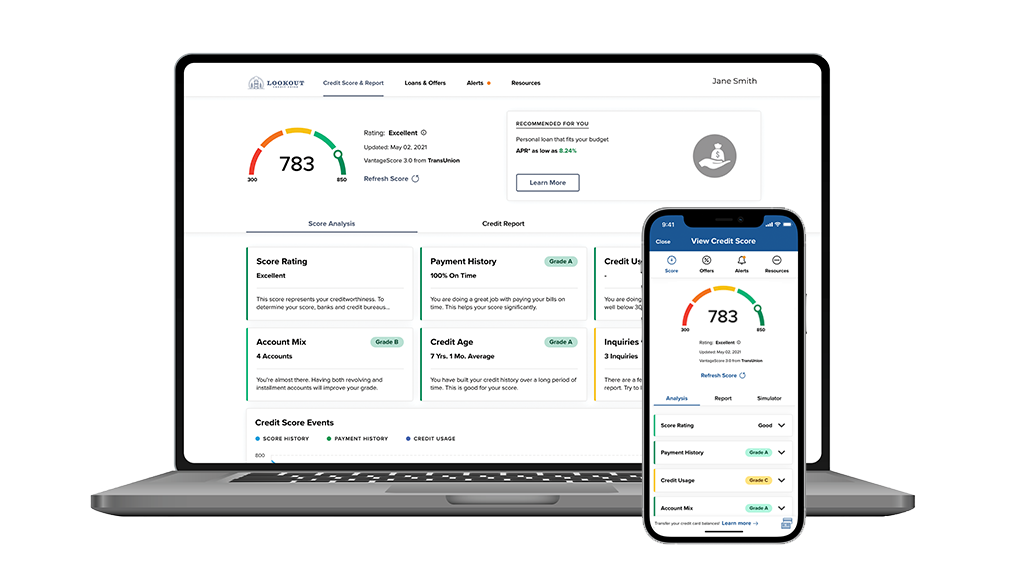

Get daily credit-score updates in Online and Mobile Banking with SavvyMoney.

SavvyMoney® Credit Score

Take Control of your Credit

The SavvyMoney® Credit Reporting Tool is Lookout Credit Union’s new credit score tool that members can access in Online and Mobile Banking. Members can use the tool to get daily updates on their credit score when they log in without lowering their score.

SavvyMoney® also gives members information on how to improve or maintain their credit. It breaks down the five major categories that make up a credit score and tells members how they’re performing in each area.

SavvyMoney® Benefits

- Check your credit score daily

- Monitor credit for unusual activity

- Dispute items on your credit report

- Get alerts for changes to your credit

- View your full credit report

- Get tips on rebuilding credit & saving money

- Get offers based on your credit

SavvyMoney® FAQs

- When Can I Start Using SavvyMoney?

SavvyMoney will be live for all online and mobile banking members beginning November 18, 2019.

- What is SavvyMoney?

SavvyMoney is the best credit score information service out there if you’re looking to crack the code of credit ratings or learn how the information on your credit reports translates into a score. SavvyMoney will help you cut through the clutter of opinions and sales pitches to get to the facts of how you can use your credit to accomplish your life goals.

- How can SavvyMoney help me?

Tools offered by SavvyMoney include:

- A free credit score every month with the ability to refresh daily

- Personalized analysis of each component of your score

- Clear, simple explanations of factors impacting your score

- Videos and daily articles from personal finance expert Jean Chatzky

- Is SavvyMoney really free?

There is no cost to you whatsoever for the SavvyMoney credit score services or products provided by the Credit Union.

- Will accessing SavvyMoney impact my credit and potentially lower my credit score?

No. Checking SavvyMoney is a “soft inquiry,” which does not affect a credit score. Lenders use “hard inquiries” to make decisions about credit worthiness when you apply for loans.

- How does the SavvyMoney Credit Score differ from other credit scoring offerings?

SavvyMoney pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

- Will Lookout Credit Union use SavvyMoney to make loan decisions?

No, Lookout Credit Union uses its own lending criteria for making loan decisions.

- If Lookout Credit Union does not use SavvyMoney to make loan decisions, why do we offer it?

SavvyMoney can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—it provides you a clear picture of your credit health and can help you prepare to qualify for the lowest possible interest rate. You may also see offers on how you can save money on your new and existing loans with Lookout Credit Union.

- How does SavvyMoney keep my financial information secure?

SavvyMoney uses bank level encryption and security measures to keep the data safe and secure. Your personal information is never shared with or sold to a third party.

- What if the information provided by SavvyMoney appears to be wrong or inaccurate?

SavvyMoney makes its best effort to show the most relevant information from a credit report. If you think some of the information is wrong or inaccurate, you can “File a Dispute” with Transunion by clicking on the “Dispute” link within SavvyMoney. If the inaccuracy is verified, Transunion will update your report. We would also suggest you obtain a free credit report from the other bureaus at www.annualcreditreport.com, and then dispute inaccuracies with each bureau individually. Each bureau has its own process for correcting inaccurate information.

- Will Lookout Credit Union reprice current loans using my SavvyMoney credit score?

No. Lookout Credit Union does not automatically reprice loans using the SavvyMoney score. Your loans are priced from the credit union’s lending criteria at the time of funding.

- How do I get ahold of the credit bureaus if I have questions about my credit?

The credit bureau phone numbers for each of the credit bureaus are listed below:

TransUnion

- TransUnion has one main number to call for all questions 1-800-916-880

Experian

- Buying a credit report, Placing a fraud alert on your credit file 1-888-397-3742 or1-888-397-37426 (1-888-EXPERIAN)

- Question about a recent credit report 1-714-830-7000

- Question about Experian membership account 1-877-284-7942 (press three)

Equifax

- Equifax General inquiries 1-800-465-7166 (press one and then 90)

- Canceling a product or service (Equifax customers) 1-866-640-2273 Request a copy of your credit report

- Place a fraud alert on your credit card, Dispute information in your credit report 1-866-349-5191

- Place, lift or remove a freeze on your credit 1-888-298-0045

- Dedicated phone line for information on the 2017 data breach 1-866-447-7559

SavvyMoney® Special Offers

Based on your SavvyMoney Credit Score, you may receive offers from Lookout Credit Union on related products or services. In most cases, these offers may have lower interest rates than the products you already have.

Offers may include:

- Balance Transfers

- Lower Car Payments

- And more...

Members Love Us

"I have been a Member of the Credit Union for over 14 Years now. They enabled me to buy a car with a pre-approved letter, that really helped me in my auto buying selection. I love my credit union!"

- Jim A.

"I got my Home Equity Line of Credit a couple of years ago and the process was quick and easy. I've enjoyed the simplicity of my HELOC and appreciate the rate and working with the credit union. It's easy to advance the money online and to also make payments online."

- Cam S.

"I love this account because it has so many features that I use on a regular basis - $25 in monthly ATM fee refunds – great rate, free cashiers checks and more!"

- John W.

"Excellent support. Their built in money management tool, fully into the debit cards and online banking, is a must have for budgeting."

- J.K.M

"I’ve been banking at Lookout Credit Union for many years now. They are always kind and courteous and prompt when I come in. When online banking came out, one gal at the office spent 15 minutes with me, taking time to answer all of my questions and concerns. When one of my accounts was compromised, they immediately calmed me and took steps to protect any further problems."

- Nat C.

"I have been a Member of the Credit Union for over 14 Years now. They enabled me to buy a car with a pre-approved letter, that really helped me in my auto buying selection. I love my credit union!"

- Jim A.

"I got my Home Equity Line of Credit a couple of years ago and the process was quick and easy. I've enjoyed the simplicity of my HELOC and appreciate the rate and working with the credit union. It's easy to advance the money online and to also make payments online."

- Cam S.

"I love this account because it has so many features that I use on a regular basis - $25 in monthly ATM fee refunds – great rate, free cashiers checks and more!"

- John W.

"Excellent support. Their built in money management tool, fully into the debit cards and online banking, is a must have for budgeting."

- J.K.M

"I’ve been banking at Lookout Credit Union for many years now. They are always kind and courteous and prompt when I come in. When online banking came out, one gal at the office spent 15 minutes with me, taking time to answer all of my questions and concerns. When one of my accounts was compromised, they immediately calmed me and took steps to protect any further problems."

- Nat C.

"I have been a Member of the Credit Union for over 14 Years now. They enabled me to buy a car with a pre-approved letter, that really helped me in my auto buying selection. I love my credit union!"

- Jim A.

"I got my Home Equity Line of Credit a couple of years ago and the process was quick and easy. I've enjoyed the simplicity of my HELOC and appreciate the rate and working with the credit union. It's easy to advance the money online and to also make payments online."

- Cam S.

"I love this account because it has so many features that I use on a regular basis - $25 in monthly ATM fee refunds – great rate, free cashiers checks and more!"

- John W.

"Excellent support. Their built in money management tool, fully into the debit cards and online banking, is a must have for budgeting."

- J.K.M